- Reasons to cancel e-invoice

- How to cancel e-invoice

- Timelines to cancel e-invoice

- Rules and key points related to e-invoice cancellation

- How to cancel e-invoice in tallyprime

e-Invoicing is a process that requires businesses to upload and get the invoices authenticated with IRN and QR code from the invoice registration portal (IRP). Post authentication, the supplier must print the QR code embedded with IRN on the invoices before issuing it to the buyer. Read How to Generate e-Invoice in GST to know more. Owing to various reasons, you might have to cancel the e-invoice for which IRN and QR code is already generated. In this blog, we will talk about the reasons, timelines and how to cancel e-invoice in GST.

Reasons to cancel e-invoice

The supplier can cancel the e-invoice that is already reported to the IRP system and for which IRN is generated. The supplier can cancel the e-invoice for any of the reasons listed below:

- Order cancellation by the buyer

- Incorrect or wrong entry in the e-invoice

- Mistakes in e-invoice

- Duplicate entry and so on.

To overcome such situations, a provision is provided to the taxpayer to cancel the invoice reference number (IRN).

| Best e-Invoicing Software Solution for Businesses in India | Generate e-Invoice Instantly in TallyPrime |

How to cancel e-invoice

Just like you can generate e-invoice using the various mode, e-invoice cancellation can also be done using different modes such as from e-invoice portal or from the ERP/Accounting software or business management software that use API’s to directly interact with the portal.

First, let’s discuss how to cancel an e-invoice from the portal.

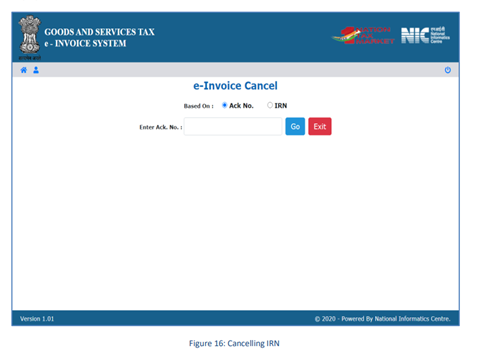

To cancel the e-invoice, you need to login to e-invoice portal and follow the steps given below.

Step-1: Login to https://einvoice1.gst.gov.in/

Step-2: Select ‘e-Invoice’ from the main menu

Step-3: Select ‘cancel’ option available in the e-invoice menu

Step-4: Select and mention e-invoice ack.no or IRN

Step-5: After mentioning, click ‘Go’

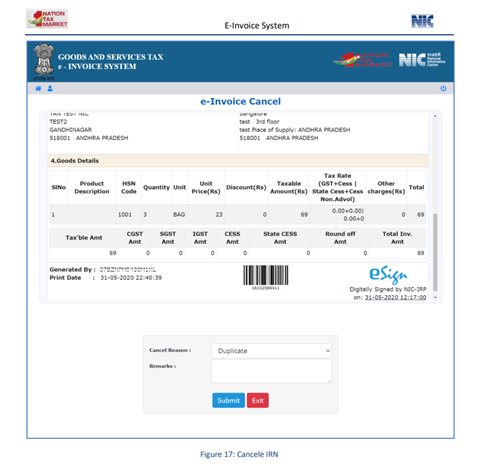

Step-6: Next, the system will display the e-invoice that you want to cancel

Step-7: Select the cancellation reasons, mention the remarks and submit

Step-8: After submitting, a success message along with the cancelled e-invoice with a “Cancelled” watermark is displayed.

If you are using a business management software that is directly integrated with the IRP portal via GSP, cancellation of e-invoice is much easier. All you need to do is just mark the invoice has cancelled. The business management software will automatically interact with IRP portal to cancel the e-invoice.

Timelines to cancel e-invoice

The e-invoice portal is designed to store the invoice data for a maximum of 24 hours. As a reason, the e-invoice can be cancelled within 24 hours of generation of the IRN. After 24 hours of e-invoice generation, e-invoice cannot be cancelled.

Rules and key points related to e-invoice cancellation

- An e-invoice can be cancelled on the IRP within 24 hours of generation of the IRN

- Beyond 24 hrs, you can either issue a debit note or credit note to nullify the invoice information or edit the GSTR-1 to modify the invoice details.

- If an e-Way Bill is already generated for the IRN, it cannot be cancelled

- Partial cancellation of e-invoice is not allowed. Hence, the whole of the invoice needs be cancelled

- If e-Invoice is cancelled, the same invoice number cannot be used again to generate another IRN

- In case an IRN is cancelled, then GSTR-1 will also be automatically updated with the cancelled status.

How to cancel e-invoice in TallyPrime

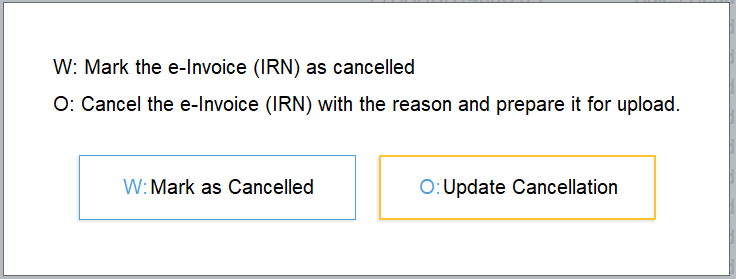

TallyPrime, powerful business management software comes with fully integrated e-invoice solution that allows businesses to generate e-invoice instantly without the need for manual intervention. e-invoicing in TallyPrime is so fast and simple that you need not do anything more to generate e-invoice. A similar experience is extended to cancel e-invoice as well.

To cancel an e-invoice in TallyPrime, you just need to select the invoice for which IRN is already generated and select ‘update cancellation’ along with a reason. The system will automatically prepare it for cancellation by directly interacting with the IRP portal.

Watch How to Get IRN Info using TallyPrime

Watch How to Cancel e-Invoice in TallyPrime

Watch Video on How to Undo IRN Cancellation of E-invoice in TallyPrime

Video on e-invoicing in TallyPrime

Know more about e-invoices in GST