- Understanding GST Payments

- GST Payment Modes

- Steps to Generate a Challan and Pay GST Online

- Importance of GST cash and credit ledger

- Common Mistakes and How to Avoid Them

- GST Payment Deadline and Penalties

- GST Payment Online FAQs

GST payment is one of the major requisites for a business to stay compliant according to tax laws in India. As per the guidelines, every registered business must make monthly GST payments along with the submission of GSTR-3B return.

GST payments are necessary to claim TDS deductions and Input Tax Credit. Timely GST payments will help prevent penalties and other legal actions against your company. It is also important for getting business loans approved.

Understanding GST Payments

GST payment is the periodical remittance of GST amount payable by the business. There are different types of GST:

- CGST: CGST stands for Central Goods and Services Tax is levied by the central government for the intrastate movement of goods and services.

- SGST: SGST or State Goods and Services Tax is charged by the state government on intrastate supplies of goods and services. It is charged in addition to the (CGST)

- IGST: Integrated Goods and Services Tax is tax paid to the central government on interstate purchases or supplies of taxable services and goods and imports of services and goods.

These payments collected are remitted via the GST portal using online or offline mode.

GST Payment Modes

The two modes of GST payments are as follows:

Online mode

You can make your GST payments online by using net banking, debit card, and credit card. It is not mandatory for you to log into the GST portal to pay using the online methods. You can make an online payment using most of the popular banks in India.

Once you complete the GST payment, the electronic cash ledger is instantly updated to reflect the successful payment. In the case you have not logged in but have generated challan, it is recommended that you pay as soon as you can.

Offline mode

You can pay using NEFT (National Electronic Fund Transfer), RTGS (Real-Time Gross Settlement), or OTC (Over the Counter) payment methods. The OTC method includes payment using demand draft, cheque, and cash.

The OTC method can take a few days and the electronic cash ledger is updated once the banks process the payment. It must be noted that the maximum amount payable using OTC is ₹10000.

You must generate GST challan prior to paying using the offline modes. It doesn’t matter whether you generated the challan after logging into the portal or without logging in. You must print the challan, fill in the required details, sign, and then submit to your bank so the payment can be processed.

If you use the RTGS/NEFT method then you will have an additional step which is to get the UTR (Unique Transaction Reference) number from the bank and then log into the portal to ensure the electronic cash ledger is up-to-date.

Steps to Generate a Challan and Pay GST Online

Here's a step-by-step process for how to make your GST payment online:

- Log in to the GST Portal

- Click on Services indicated on the Dashboard

- Navigate to Payments

- Click on Create Challan

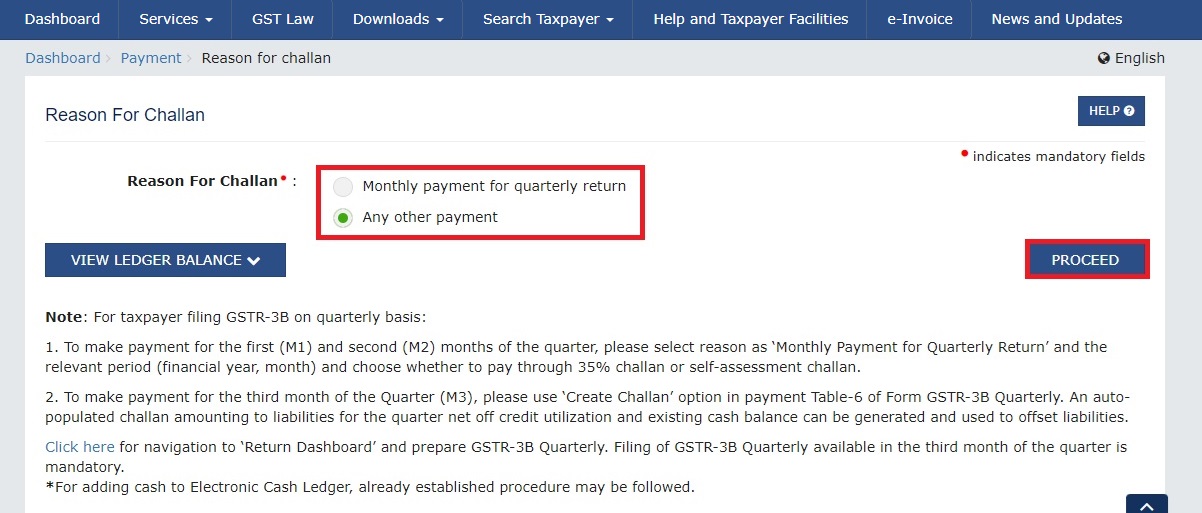

- Select the reason either as Monthly payment for quarterly return or Any other payment on the Reason for Challan page displayed.

- Click on Proceed

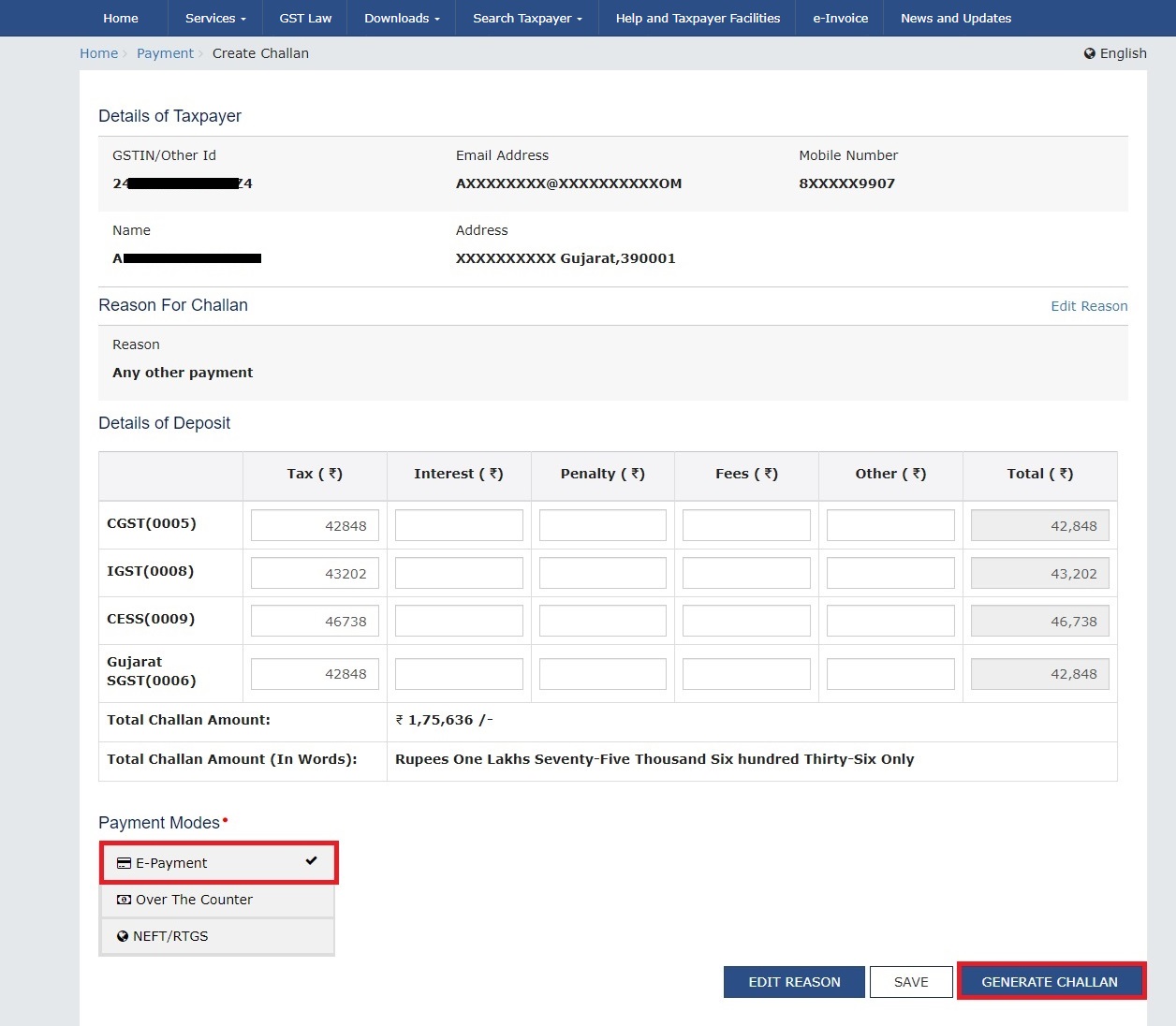

- Enter the details of the GST payment

- Select Payment Mode

- Click on Generate Challan

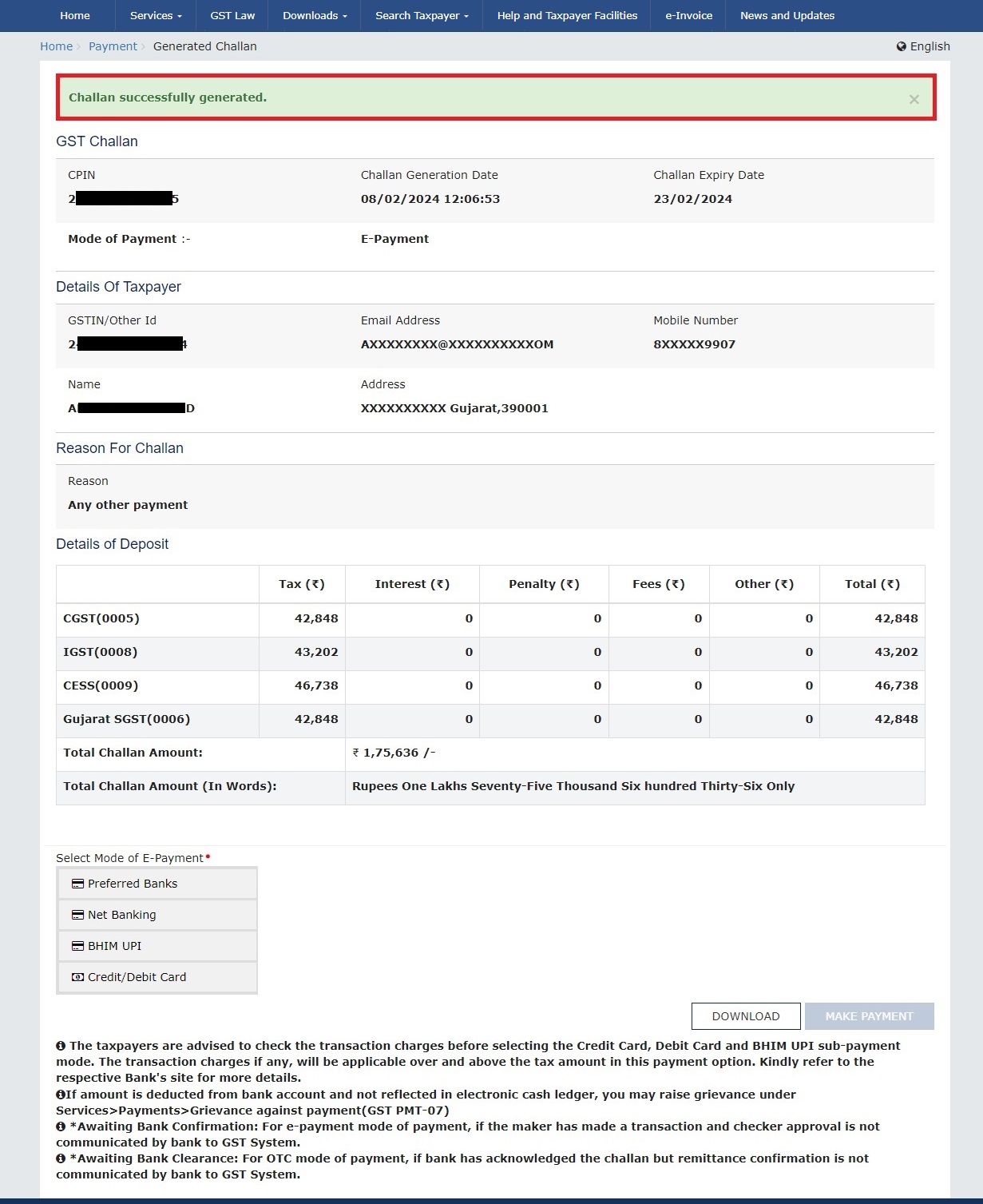

- Verify details of the challan

- Click on Make Payment

Note: If the payment is to be made by NEFT or RTGS, a mandate form will be generated along with the challan on the GST portal. The mandate form has to be submitted to the bank from where the payment is made. The mandate form will be valid for 15 days.

The cash remitted will be indicated in the ledger section of the GST portal. Therefore it is important to understand the significance of GST ledger for GST payment.

Importance of GST cash and credit ledger for GST payment

GST portal has an e-Ledger which contains a summary of all the deposits/payments made by a business. There are three types of ledgers maintained by the GST portal:

- GST cash ledger: Indicates the amount of GST paid in cash by a business

- GST credit ledger: Indicates the balance of Input Tax Credit (ITC) available

- GST liability register: Indicates total GST liability and the mode of payment of the liability– in cash or through credit ((if paid)

You can access these ledgers by navigating to the Services section on the GST homepage and then clicking on Ledgers. Credit in Electronic Cash Ledger can be used only for payment of tax. This can not be used to pay interest or penalties.

Common Mistakes and How to Avoid Them

Here are some of the common mistakes that businesses commit during GST payment online and how to avoid them:

- Incorrect tax amounts: Double-check the tax amounts reported in the return. Ensure that the amounts match your records and the payments made. Mistakes in reporting can lead to discrepancies and potential penalties.

- Mismatched details: Ensure that the details of sales, purchases, and ITC claimed match the records maintained by your business. Any mismatch can result in issues during audits or verification.

- Incorrect HSN codes: Use the correct HSN codes for the goods or services supplied. Incorrect HSN codes can lead to rejections or issues with ITC claims.

- Late Filing: Always file your returns on time. Set reminders and alarms to ensure that deadlines are met. Late filing attracts penalties and can affect your compliance rating.

- Omissions: Avoid leaving any fields blank or missing out on reporting certain transactions. Ensure that all taxable supplies, exempt supplies, and purchases are accurately reported.

- Error in challan details: Ensure the challan details, including the CIN (Challan Identification Number), are accurately entered in the return. Incorrect challan details can lead to payment mismatches and delays in processing.

GST Payment Deadline and Penalties

GST payment must be made by 20th of every month. As per the GST payment rules, if a person furnishes a GST Monthly Return without paying the tax due, the return furnished will be considered as an invalid return. Without furnishing the return for a month and paying the tax due, the subsequent month’s return cannot be furnished.

Also, if the tax due is not paid, interest will be applicable on the same, starting from the GST payment due date on which the tax was supposed to be paid. Hence, it is necessary to understand the GST payment method in order to avoid the penalties of non-payment of tax.

GST Payment Online FAQs

What is a GST payment?

GST payment refers to the tax paid by businesses on the supply of goods and services. It is a mandatory payment to the government based on the GST law.

How do I make a GST payment?

Login to the GST portal and generate a challan for the GST payment you wish to remit. Choose a payment mode and then click on make payment.

What are CGST, SGST, & IGST?

- CGST: Central Goods and Services Tax on intra-state supplies.

- SGST: State Goods and Services Tax on intra-state supplies.

- IGST: Integrated Goods and Services Tax on inter-state supplies and imports.

How to check GST payment status?

For checking the payment status you need not login. Visit GST portal and navigate to the Services tab. Click on Payments and go to Track Payment Status. Enter your GSTIN, CPIN and captcha code. Click on Track Status.

What is the official website for GST payment?

The official website for GST payment is www.gst.gov.in.

Can we pay GST through UPI and/or credit/debit cards?

Yes, GST can be paid using UPI, credit cards, and debit cards on the GST portal.

How to download GST challan?

- Log in to the GST portal.

- Go to "Services" > "Payments" > "Challan History."

- Enter details and download the challan PDF.